The 45-Second Trick For Mortgage Brokerage

Wiki Article

7 Easy Facts About Mortgage Brokerage Explained

Table of ContentsMortgage Broker Assistant Job Description Can Be Fun For AnyoneThings about Broker Mortgage MeaningThe Ultimate Guide To Mortgage Broker AssociationThe Greatest Guide To Mortgage Broker AssistantThe Ultimate Guide To Mortgage BrokerNot known Facts About Mortgage Broker Assistant Job DescriptionThe Best Guide To Mortgage Broker AssociationNot known Incorrect Statements About Mortgage Brokerage

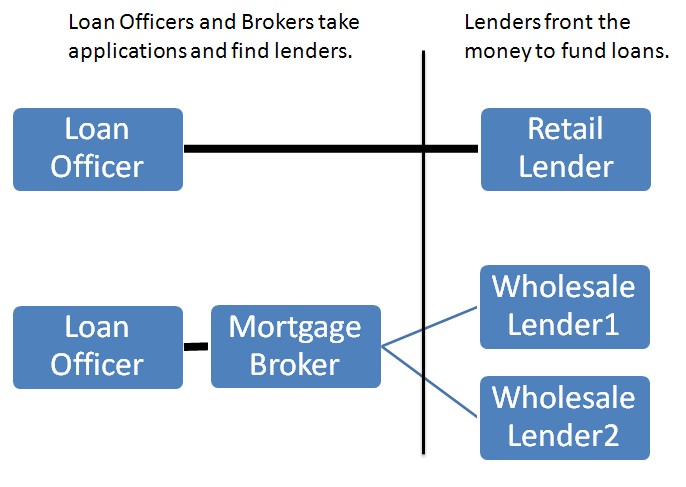

What Is a Mortgage Broker? A home loan broker is an intermediary between a banks that uses lendings that are secured with realty and individuals interested in purchasing property that require to obtain money in the type of a lending to do so. The home mortgage broker will function with both parties to get the specific accepted for the car loan.A home mortgage broker commonly collaborates with many various lenders and can use a selection of finance alternatives to the debtor they deal with. What Does a Mortgage Broker Do? A mortgage broker intends to complete property transactions as a third-party intermediary between a borrower and a loan provider. The broker will collect details from the private and also go to numerous lenders in order to discover the ideal prospective lending for their customer.

The Greatest Guide To Broker Mortgage Fees

All-time Low Line: Do I Need A Home Mortgage Broker? Dealing with a home mortgage broker can save the borrower time as well as effort during the application process, as well as potentially a whole lot of money over the life of the financing. In addition, some loan providers work exclusively with home loan brokers, indicating that debtors would have access to car loans that would certainly otherwise not be readily available to them.It's vital to check out all the costs, both those you may need to pay the broker, as well as any kind of costs the broker can aid you stay clear of, when evaluating the decision to collaborate with a home loan broker.

The 6-Second Trick For Mortgage Broker Job Description

You've probably heard the term "home loan broker" from your property representative or close friends who have actually purchased a house. But what specifically is a home loan broker and what does one do that's various from, say, a financing officer at a financial institution? Geek, Budget Overview to COVID-19Get response to concerns regarding your home loan, travel, funds and maintaining your peace of mind.What is a mortgage broker? A home loan broker acts as an intermediary between you and also prospective loan providers. Home loan brokers have stables of lenders they work with, which can make your life less complicated.

The Basic Principles Of Mortgage Broker

Just how does a home loan broker make money? Home mortgage brokers are usually paid by lending institutions, in some cases by consumers, but, by regulation, never ever both. That regulation the Dodd-Frank Act also prohibits mortgage brokers from billing hidden charges or basing their compensation on a customer's rate of interest rate. You can additionally choose to pay the home mortgage broker on your own.What makes home mortgage brokers different from lending policemans? Lending police officers are staff members of one lending institution that are paid set incomes (plus incentives). Funding officers can compose just the types of financings their employer picks to provide.

Mortgage Broker Job Description Things To Know Before You Buy

Home loan brokers might be able to offer borrowers accessibility to a broad choice of lending kinds. You can conserve time by making use of a home mortgage broker; it can take hrs to apply for preapproval with various lending institutions, after that there's the back-and-forth communication involved in financing the loan and making sure the deal remains on track.When choosing any type of loan provider whether with a broker or directly you'll desire to pay interest to lending institution costs. Especially, ask what fees will certainly show up on Web page 2 of your Lending Quote type in the Funding Expenses section under "A: Source Charges." Then, take the Car loan Estimate you obtain from each lending institution, put them side-by-side and compare your rates of interest and all of the fees and also shutting expenses.

The Ultimate Guide To Mortgage Broker Assistant

Exactly how do I select a home loan broker? The ideal method is to ask buddies and also loved ones for references, but make sure you could check here they have actually used the broker and also aren't just going down the name of a previous university flatmate or a distant colleague.

Get This Report on Broker Mortgage Fees

Competition as well as residence prices will affect just how much mortgage brokers earn money. What's the difference between a mortgage broker and a car loan police officer? Home loan brokers will certainly function with numerous lenders to discover the best funding for your scenario. Lending policemans work for one lending institution. Just how do I locate a home mortgage broker? The finest means to find a home loan broker is through references from household, good friends and your real estate representative.

Some Known Questions About Mortgage Broker Assistant Job Description.

Getting a new house is just one of one of the most complicated occasions in a person's life. Residence differ considerably in regards to design, amenities, school area as well as, certainly, the constantly vital "area, location, place." The home loan application procedure is a challenging aspect of the homebuying procedure, specifically for those without previous experience.

Can establish which problems might develop difficulties with one lending institution versus another. Why some purchasers prevent home loan brokers Often homebuyers feel extra comfortable going directly to why not try these out a large bank to protect their loan. Because situation, buyers should a minimum of speak with a broker in order to recognize all of their alternatives pertaining to the kind of finance and the available rate.

Report this wiki page